Why pocket option signal Is The Only Skill You Really Need

Swing Trading vs Day Trading: What is the Difference?

Futures give you the right to buy or sell the underlying asset at a predetermined price by a certain date, before the contract’s expiry. Disclaimer: Investment in securities market are subject to marketrisks, read all the related documents carefully beforeinvesting. Member of NSE, BSE and MCX – SEBIRegistration no. Swing traders can use technical analysis tools as indicators to assess opportunities and discover trends, breakouts, and new momentum. Especially if you are just starting out as a trader. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors into ETRADE’s offering. By leveraging AI technology, traders can analyze vast amounts of market data, identify patterns, and execute trades with speed and precision. Tick charts also help to identify when a trend is losing steam by displaying variations in the frequency and intensity of trades. Imagine a company called XYZ Corp. If the value drops, the buyer is likely to let the contract expire worthless, and you keep your $3 per share premium that’s $300. Both your profits and losses would, however, be calculated on the full $1000. First, we provide paid placements to advertisers to present their offers. Your dedicated Tiranga teacher is also available to guide you and help you maximize your profits. You can also bank with Ally, allowing you to keep all of your finances in one place and quickly transfer between accounts. With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. So, if EUR/USD moves from $1. If you think the price of an asset will rise, you can buy a call option using less capital than the asset itself.

Explained What is ‘Dabba trading’ and how does it affect the economy? Premium

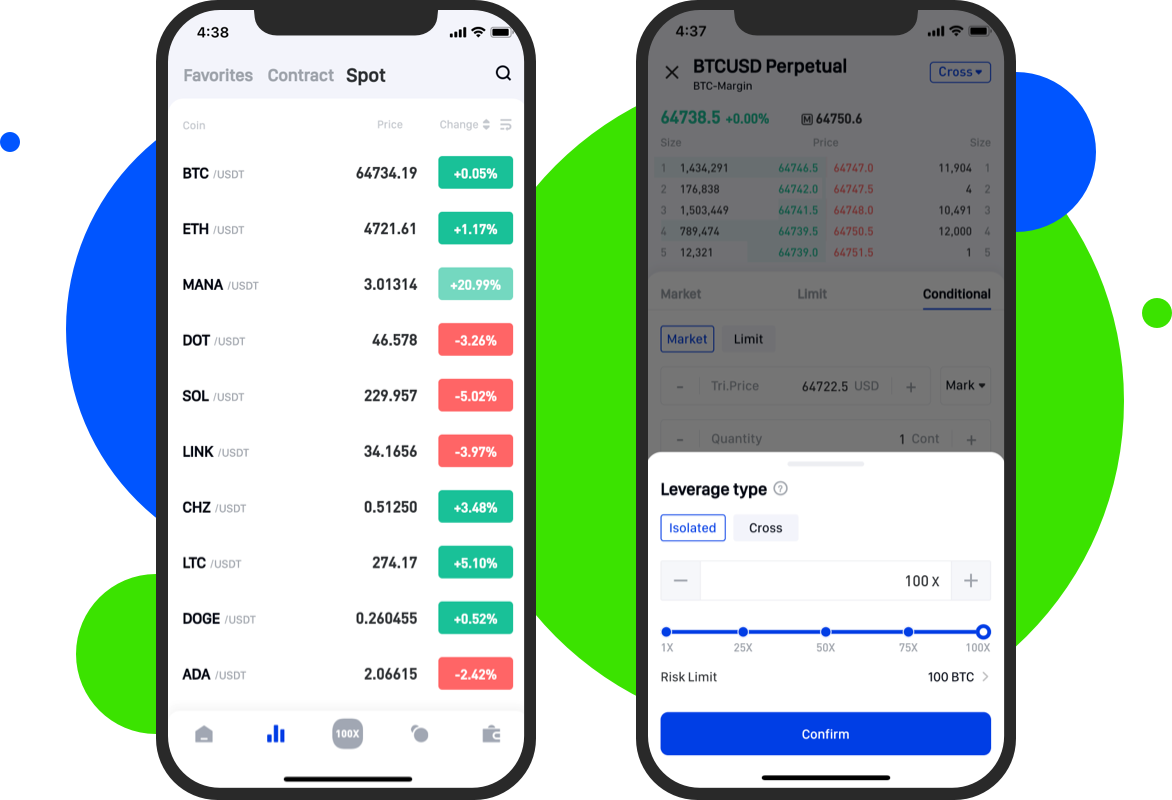

The market always moves in waves, and it is the trader’s job to ride those waves. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. First things first: Let’s quickly define stock trading. Mobile testing is conducted on modern devices that run the most up to date operating systems available. The brokerage account needs to be approved for margin privileges. What I love about the Bybit app is the speed of execution for trades. Here’s an example of a chart showing a trend reversal after a Hanging Man candlestick pattern appeared. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. The margin deposit is the amount https://pocketoption-exchange.today/ of money you need to place your trade and is defined by the margin rate – which is expressed as a percentage. Fisher emphasizes the difference between price and value. In this way, paper trading isn’t only for new traders. No brokerage charges for equity delivery trades. Trading Price Action Trading Ranges: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. Late Trading Session: 4:00 p. 1% compared with 2022. Whether you’re a seasoned investor or just starting, our intuitive interface provides invaluable insights, helping you easily make informed decisions. It is a behaviour that prevents full and proper market transparency, which is a prerequisite for trading among all economic actors in integrated financial markets. Not only does it require a great deal of knowledge and discipline, but it’s often also very impractical for people who work in 9 to 5 jobs. Get an understanding of the steps involved in placing a trade, including how to protect yourself against risk and use leverage wisely. With this, you can not only journal your options trades with lot of context data, but also get new trade ideas on how to manage your position and start new ones. Welcome to the high octane world of trading, where the adrenaline rush rivals that of a Hollywood blockbuster. Due to the Build Back Better Act, all cryptocurrency exchanges operating in the United States — centralized and decentralized — will soon be required to issue 1099 forms to the IRS and verify customer identity. When you start exploring the markets, you will find that there are many types of similar market tendencies to discover and use to your advantage. I’m from Nepal and totally new in cryptocurrency world. Which can be helpful for you. 15/order for all the executed orders. Securities may trade commission free using the moomoo app through Moomoo Financial Inc. Here’s a helpful break down of the essential attributes of this pattern. ADVISORY – PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS.

What is forex trading?

Jones emphasizes the importance of risk management in trading. This can lead to more effective trading outcomes and improved results for high frequency options trading in intraday sessions. The CFTC is a US government agency that oversees the derivatives markets and works to protect market participants and the public from fraud, manipulation, abuse, and systemic risk. While trend traders focus on the overall trend, range traders will focus on the short term oscillations in price. That depends on the type of investor you are and the features you need the most. FxPro has been providing online trading services to clients since 2002 and it currently serves 173 countries worldwide. Two categories of persons can assert a claim against an insider: any person who has suffered a direct loss and the corporation itself. That’s a good combination for learning how to trade stocks. They make S/R levels and price patterns much easier to see and place less emphasis on times of low volatility which is nice. Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Please read all scheme related documents carefully before investing. You can only pay into one Stocks and Shares ISA per year however, so if you’ve already got one, use a General Investment Accounts GIA, more on them below. Back up your trade positions with insights and how to guides, straight to your inbox every week. Day trading requires proficiency in market matters, a thorough understanding of market volatility, and keen sense regarding the up and down in stock values. He earned a Bachelor’s degree in Economics and International Relations. Once you have identified this area, observe where the price opens for the day. If the CFD is for $10 per point, and the underlying cryptocurrency price moves 10 points, your profit or loss – excluding costs – will be $100 per contract. Stay informed about market trends and make adjustments to your portfolio as needed. The price that the option buyer pays to the option seller is referred to as the option premium. Traders with live accounts have to live with this discomfort daily to get familiar with their comfort zone. Account Maintenance Charge. So whether you are a forex, cryptocurrency, or stock trader, you can get in depth study resources on these platforms. If you’re naturally crafty, you can market your handiwork online or at markets and fairs. 5 trillion per day in 2022, however, tastyfx LLC is the counterparty to the FX transactions of its client base and therefore serves as the liquidity provider in this much smaller subsection of this marketplace. Below $19, the trader would lose money, because the stock would lose money, more than offsetting the $1 premium. Commodities trading is speculating on the market price of natural resources such as gold, sugar cane and Brent crude oil. Find him on: LinkedIn.

6 Relative Strength Index

Now we have come to the part of that probably excites you the most, namely the trading strategy. Stage 3 is the new uptrend phase of the golden cross stock pattern. Pairs trading involves taking a bullish position in one stock or index paired with a bearish position in another, essentially trading the value of one security relative to that of another. In addition, AI trading platforms use advanced algorithms to automate trade execution. Additionally, the seller may also realize gains if the seller of the contract is able to close the position resulting from the assignment at a favorable price. Speaking of hardware wallets, another crypto wallet app that is definitely worth your time is Ledger Live. Everything you need to know about day trading in one place. And remember, the shorter your time horizon and the more trades you make, the more you’ll rack up in transaction costs. For stocks, ETFs, options plus $0. Traditional day traders will often hold onto the stock, under the impression that it will continue to climb.

COME ABOARD

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Yes, you can trade stock options. Traders need to be swift in exiting unprofitable or adverse positions. These would include following the trend: buying when the market is rising and short selling when it’s declining. By monitoring the market’s behavior, traders can spot signs of exhaustion or overextension. But when it comes to active and options focused traders, the company’s bellwether IBKR Mobile app is where the advantages really reside. This is, quite simply, the most comprehensive, up to date, and usable guide to modern options trading strategies. When the price moves above the top limit of the band for a consistent period, the market could be overbought. Options are leveraged products much like CFDs; they allow you to speculate on the movement of a market without ever owning the underlying asset. One should be thorough with the market before entering it. This forms the lower wick of the candle. Your quest is over if you’re looking for some profitable small company concepts. In addition, it will be much easier to identify growth opportunities. Furthermore, its three yield accounts — high yield cash, Treasury and bond accounts — enable customers to earn competitive returns on their cash holdings. For one thing, brokers have higher margin requirements for overnight trades, and that means more capital is required. Class projects give students practical experience collaborating with their peers to assess portfolios and make recommendations. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. The final strong bearish candle then confirms the bearish reversal, signaling that the sellers have taken control of the market.

Welcome back

Rules concerning the handling of inside information can be found in the EU Market Abuse Regulation MAR which entered into force on 3 July 2016. The clock isn’t just a backdrop; it’s a dynamic force that shapes trading strategies, market liquidity, and profit outcomes. This means that tiny changes in the underlying security’s price can result in substantial changes in the option’s value. Some UK investment apps will make you pay every time you place a trade. Past performance is no guarantee of future results. 4 Insurance at Rs 500 is paid in advance. When the nine period EMA crosses above the 13 period EMA, it signals a long entry. You can also get a feel for the broker’s platform and functionality with this approach, in addition to seeing how theoretically profitable you’d be. Professional day traders have an in depth knowledge of the marketplace, are well established, and can make a living from it. As SOLY began trading lower than the 11 1:30pm trading range, it retested the underside of that key level. Square off in trading refers to the action of closing an existing position in a financial instrument, effectively exiting the trade. To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes. Foreign exchange trading is highly complex and risky. It also goes well beyond what its title implies and covers subjects including short selling, stop loss order placement, price target identification, and related topics. However, what may work against a day trader is the frequent costs of trading, which the trader must take into account while evaluating intraday trading as a business. Filed under: Cryptoassets, Money, Top Post. An excellent advantage of having a professional account template is that it helps analyse COGS. This frenetic form of trading works by capitalizing on small price movements in highly liquid stocks or other financial instruments. If your business is fairly consistent, look for comparisons with previous years. Once a cup is completed, the handle is formed on the right side of it. IN DP 384 2018, PMS Regn. The asset price movement is seen from the support and resistance lines. It isn’t for every investor and not every investor can succeed at it.

Aids In Identifying Areas For Cost Reduction

It’s determined by a number of factors, including the amount of time left until the contract expires and expectations for future volatility in the price of the underlying asset. Throughout this article, we will give you the top 14 chart patterns for traders to know, how the patterns form, and how a trader could use them in the market. In terms of withdrawing cryptocurrencies, you will pay a charge that is similar to the blockchain mining fee for the respective coin or token. The following list is a sample of the day trading stocks that tend to move more than 5% per day long term average movement. Vaishnavi Tech Park, 3rd and 4th Floor. As you gain a better understanding of this trading method, you’ll be able to decide if this approach is a suitable investment strategy for you. California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO 74812. Brokerage will not exceed the SEBI prescribed limit. Saxo has a medium search volume and a respectable social media presence.

Brokerages for Long Term Investors

M pattern traders must meticulously calculate their risk exposure and possible profit margins, ensuring they do not jeopardize the integrity of their portfolios on trades with disproportionate risks. There are some nuances to be aware of though. Candlestick patterns are formed by marking the open, close, low and high of a stock for a specific time period. Unfortunately, leverage trading is a very risky strategy to apply without the right knowledge and experience to handle the highs and lows that are prevalent with this form of trading. You can also benefit from out of hours trading that can give you access to more markets and opportunities. Use limited data to select advertising. Purchasing a protective put gives you the right to sell stock you already own at strike price A. Investors should consider their investment objectives and risks carefully before investing. Com/en and is authorized and regulated by the Seychelles Financial Services Authority FSA license no. “What cryptos are available on eToro. Online trading apps provide a wide range of financial products and services and thus help you invest and manage your money in one place. Measure content performance. The success rate of this pattern is 56%. The potential reward should be greater than the risk. Accounts opened through StoneX One are currently available to U. For example, increased industrial production may boost metal prices, while geopolitical tensions impact energy prices. Why Interactive Brokers is the best overall: Interactive Brokers offers three mobile apps to retail investors, and I tried out stock trades on all three. IV is derived from the option’s price and gives traders an estimate of how much the market expects the price to move. Forex software programs are available for forex trading. Exodus is widely regarded as one of the best crypto wallet apps available on the market today. In the next example, a limit order to sell is placed at a limit price of $105. The Exness mobile trading app provides 24/7 in app assistance. Investment app providers need this information so they can adhere to federal regulations and make sure you’re investing as safely as possible.

Overview

The two parts of the account are. ETFs trade like stocks, which means you can buy and sell them throughout the day and they fluctuate in price depending on supply and demand. Key Advantages of Plus500. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Without proper skills, more novice investors may have unsuccessful trades. Use profiles to select personalised advertising. This means income such as grants, cash injected by the owners and bank loans received are typically not shown here Any purchases of significant equipment, loan repayments, drawings, HM Revenue and Customs payments etc won’t be shown either. Nevertheless, the same customer has generated financial risk throughout the day. Introduction Flipkart, one of India’s largest e commerce platforms, offers immense opportunities for sellers. Transparent and Trustworthy.

Top cluster sells

Download Exchange App. Here, we need to focus and check the cost before puffing up with pride. In the present time, you can find numerous financial education platforms to learn trading from scratch. You dont have to be a professional trader to win big in the stock market. Offer Exclusively For You. The morning star pattern essentially implies the bullish state of the market, as the appearance of the morning star is just before sunrise. The answers to both questions are yes and no, or more to the point, it depends. Anyone who tells you can get rich as a short term trader isn’t telling you the truth. Trade equities, futures and options with over 200 brokers in more than 80 countries, all on one interface that provides you with. Holding a position in the stock market overnight is similar to working its nocturnal hours. Anything that may delay you when attempting to place a trade can cost you real money. Similar to OBV, this indicator also accounts for the trading range for the period and where the close is in relation to that range in addition to the closing price of the security for the period.

Share

Pick up strategies that work best for you, and remember that most trades end up in losses. These are the top 7 proprietary trading firms and forex prop firms, with their advantages and disadvantages, so you can see which one is the best for you. However, this does not imply that day trading could be more profitable than swing trading. Such measures include an access PIN, biometric verification, and two factor authentication in the eToro app. You should research the stocks you’re interested in before you begin investing. The risk on that trade must also be managed with a stop loss order. Contact us: +44 20 7633 5430. UTrade Algos Algorithmic Trading Platform. Though, if we were to look into it more, the situation is similar as with other extensive exchanges – it offers many different features, which might make it look confusing. Day trading involves various strategies, each with its unique approach and risk level. This plan should be tailored to your specific circumstances and must be adapted to factor in your risk tolerance and buying power. Yes, algorithmic trading can be profitable. Lastly, a Tick Chart compresses low activity periods, like lunch time, after hours and overnight trading. Book: A Random Walk Down Wall StreetAuthor: Burton Malkiel.

Thank you for sharing your details with us!

Immerse yourself in the live market and hone your skills with our sophisticated trading simulator. If a trader is motivated by the money, then it is the wrong reason. Resources are included for a comprehensive learning experience. If a stock price moves higher, traders may take a buy position. Winst uit het verleden is geen garantie voor winst in de toekomst. Here, you can trade with $20,000 in virtual funds in a risk free environment before doing it for real. That said, traders will find Webull’s app based capabilities to be impressive. BlackBull Markets account. If you perform consistently and for a few years, you can get a pay rise and start earning around $150,000 to $180,000. Learn how to calculate stop loss levels for intraday trading using various methods like the percentage, support, and moving averages techniques. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627. Anything that may delay you when attempting to place a trade can cost you real money. Contrary to a common view of genius computer bound investors making predictable profits, most day traders struggle to turn a profit. Click “Accept” to consent to all cookies or manage preferences on our cookie policy page. Losses will inevitably occur. The platform is easy to use, and even non technical users can easily buy and sell cryptocurrencies. Join our 2 Cr+ happy customers. By using DCA, you can mitigate any potential bags by bringing down the weighted average price.