Fixed Annuity Calculator Estimate Future Value

The difference affects value because annuities due have a longer amount of time to earn interest. Both Fixed and Variable Annuities serve as tools to manage future financial needs, but they cater to different risk profiles and financial planning strategies. The additional (1+r) at the end of the formula accounts for the extra compounding period each payment receives. Similarly, for investments, if you are investing in a mutual fund or a recurring deposit where you contribute at the beginning of each month, it aligns with the concept of Annuity Due. Conversely, receiving dividends from an investment at the end of each period would be an example of an Ordinary Annuity.

How do annuities work?

The formulas described above make it possible—and relatively easy, if you don’t mind the math—to determine the present or future value of either an ordinary annuity or an annuity due. Such calculations and their results can add confidence to your financial planning and investment decision-making. An annuity is a financial product that results in regular payments made over a period. Annuities are a reliable source of income over a period of time and especially for the people after retirement. The annuity helps to balance the financial benefits for a person and also for companies.

Future Value of Ordinary Annuity

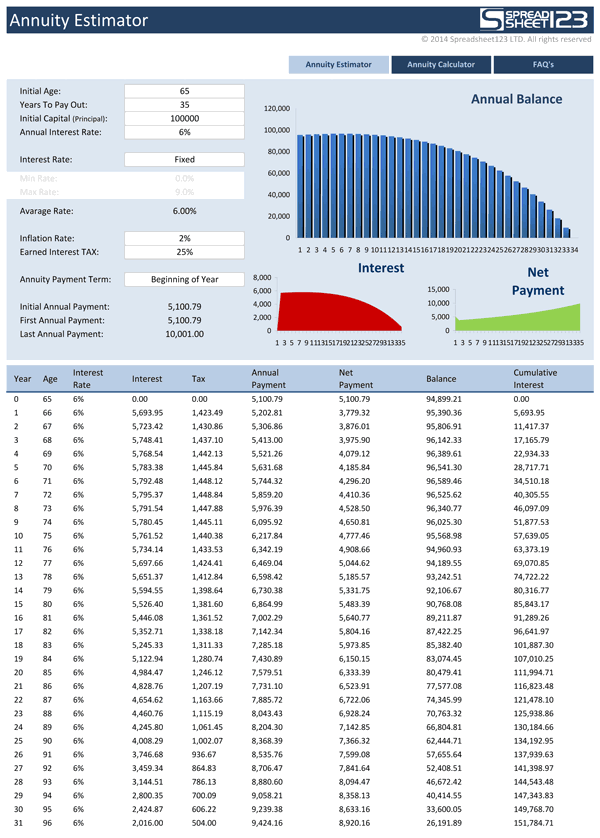

You can also follow the progress of your annuity balance in a dynamic chart and annuity table of the payment schedule. In general, types of annuities are classified according to the following features. Laura started her career in Finance a decade ago and provides strategic financial management consulting.

Annuities vs. Other Retirement Options: Pros & Cons

This calculator incorporates a number of important variables and concepts, including the time value of money. This fundamental financial concept asserts that a dollar today is worth more than a dollar tomorrow, given its ability to earn interest and grow over time. We are compensated when we produce legitimate inquiries, and that compensation helps make Annuity.org an even stronger resource for our audience. We may also, at times, sell lead data to partners in our network in order to best connect consumers to the information they request. Readers are in no way obligated to use our partners’ services to access the free resources on Annuity.org.

- In contrast to the FV calculation, PV calculation tells you how much money would be required now to produce a series of payments in the future, again assuming a set interest rate.

- All these values are for the ordinary annuity and it is best to put the values in the future value of ordinary annuity calculator.

- The future value of an annuity calculator is adjustable for finding the annuity for any time period regardless of whether we are calculating on a daily, monthly, or yearly basis.

- The calculator also lacks the ability to compare the growth of fixed annuities to that of other types of annuities.

- However, we do not sell annuities or any insurance products, nor do we receive compensation for promoting specific products.

Consider speaking with a financial planning professional before purchasing a variable annuity. Variable annuities change in value based on how the money in the annuity is invested. Because of this, the returns of a variable annuity are different each year; some years, the value of the annuity may even go down if market performance is poor. When shopping for a variable annuity, it’s important to consider the surrender charge schedule even if you don’t plan on withdrawing money from your annuity early. Financial emergencies can happen, and you may end up having to take some money out even if you didn’t plan to. So, you should always be aware of possible surrender charges before purchasing an annuity.

Fixed Annuity Calculator

Clearly, there is a tradeoff between added guarantees and receiving 100% of market gains (most variable annuities receive 100%). Unlike fixed annuities, variable annuities pay out a fluctuating amount based on the investment performance of assets (usually mutual funds) in an annuity. This type of annuity allows the most flexibility in terms of where investments can go, such as large-cap stocks, foreign stocks, bonds, and money market instruments. As a result, this type of annuity requires that an investor spend some time managing these investments. It is important to note that variable annuities do not guarantee the return of principal. Because the funds are invested in assets that fluctuate in value, it is possible for the total value of assets in a variable annuity to be lower than the principal.

When you click the “calculate” button to submit your information, the calculator will show you the expected value of your fixed annuity at the time of withdrawal. We are presenting a table by inserting the values of $1 per period (n) changes from 1 to 50 and “i” changes from 1% to 5%. We have inserted the values in the future value of the annuity calculator and rechecked all the values. The value starts from the time period “1” to “50” and the interest rate starts from 1% to 5%.

The time period between two intervals of an installment is called the future value of the annuity period. Get future values of annuity for upcoming dates with the help of this free online future value of annuity calculator. From my perspective, an ordinary annuity would be better since I could earn interest on the $100 for a full year before I made the payment to you. On the other hand, if I made the payments to you at the end of each year, our arrangement would be considered to be an ordinary annuity.

There are several ways to measure the cost of making such payments or what they’re ultimately worth. Read on to learn how to calculate the present value (PV) or future value (FV) of an annuity. dancolestaxes com Determining whether annuities are a good investment hinges on various factors, including individual financial goals, risk tolerance, and the need for future cash flow stability.

Clearly, solving this would be tedious and time consuming—not to mention prone to error. This variable annuity calculator has some limitations resulting from the assumptions it must make to estimate the value of a variable annuity. For example, the calculator assumes that the annuity’s returns are compounded annually and that any contributions are made at the beginning of each year. You can use this variable annuity calculator to estimate your annuity’s future value simply by filling out the information required.