Understanding Accounts Payable AP With Examples and How to Record AP

Third-party AP service providers offer professional teams and the latest software to do the job. When you outsource AP tasks to them, you gain access to excellent tools such as computer systems complete with customized invoicing, expense management, and other accounting software. Accounts payable outsourcing offers a pathway for companies to enhance efficiency, reduce costs, and focus on their core business activities. By selecting the right partner, leveraging technology effectively, and managing the outsourced relationship strategically, businesses can transform their accounts payable function into a source of competitive advantage. This includes not just the direct costs saved but also the indirect benefits like increased efficiency, reduced errors, and better cash flow management. A provider offering services at a very low cost might not always deliver the quality or breadth of services needed.

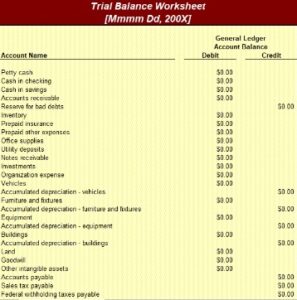

The details entered on the check, vendor bank account details, payment vouchers, and the original bill and purchase order must be scrutinized. Ledger accounts need to be updated based on the received bills and an expense entry is usually required. Managerial approval might be required at this stage with the approval hierarchy attached to the bill value. Accounts payable are found on a firm’s balance sheet, and since they represent funds owed to others they are booked as a current liability. When using the indirect method to prepare the cash flow statement, the net increase or decrease in AP from the prior period appears in the top section, the cash flow from operating activities.

It could refer to an account on a company’s general ledger, a department, or a role. Yet, no matter where the term appears, it’s always related to the amount of money a business owes to other entities within a specific timeframe. Accounts Payable and Receivable are usually different departments in larger companies. However, smaller businesses may combine their accounts receivable and accounts payable into one department. They are typically responsible for more than just paying incoming bills and invoices.

MineralTree – Best for Security and Compliance

The skills and knowledge you’ll use in your role as an accounts payable specialist will vary somewhat depending on the industry and organization you work for, but you may notice some overlap when searching job postings. Start by mastering accounting fundamentals and building a core set of essential skills. In many organizations, the person in charge of paying the bills is the accounts payable specialist. This is a common entry-level position that can lead to a long career in accounting. Businesses should establish clear communication channels and expectations with their outsourcing provider from the outset to address communication challenges. This may include regular progress updates, meetings, and clearly defined points of contact to ensure that any issues or avoidable cost concerns are promptly addressed and resolved.

Moreover, invoice processing speed is limited by your staff’s abilities and work hours. Third-party accounts management companies have modern facilities and software to efficiently and accurately accomplish tasks. This includes not only processing invoices but also managing payments, ensuring compliance, and handling vendor queries. Providers with experience 25 tax deductions for a small business 2020 in your industry or similar business sizes can offer tailored solutions that better fit your needs. Accounts payable outsourcing is the strategic delegation of a company’s AP functions to external specialists, optimizing efficiency and accuracy. In its essence, this process involves entrusting the management of accounts payable – a key financial operation encompassing the handling of outgoing payments to suppliers and vendors – to a third-party service provider.

Should you outsource accounts payable?

- Some of the most frequently outsourced processes include invoice receipt and processing, vendor management, and payment processing.

- With the latest technology, an intelligent interface automatically finds and verifies financial information and integrates with other applications automatically, so you spend less time searching for and entering data.

- If managing AP internally is proving to be cumbersome, error-prone, or too costly, outsourcing could offer a much-needed solution.

- Overall, the platform automates the entire invoice-to-payment process, enhancing efficiency and accuracy while reducing processing costs.

- If they experience any issues that interrupt service for you, there’s little you can do to make sure your own vendors are still getting paid on time.

Add it up, and you’ll be uniquely positioned to offer your clients creative plans for realizing a positive, profitable future. Whether you’re an accountant, a small business owner, or a professional working within an organization, understanding what accounts payable is and how it works is essential. This is simply in reference to the fact that the account represents the company’s short-term liabilities. While the business size ultimately determines the role accounts payable plays, AP fulfills at least three essential functions besides paying bills.

This ensures that the total of accounts payable reported on the balance sheet is accurate. Because accounts payable entries are not immediately paid, they are listed as a current liability on a business’ general ledger and balance sheet. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. The accounting entry to record this transaction is known as Accounts Payable (AP). Management can use AP to manipulate the company’s cash flow to a certain extent. For example, if management wants to increase cash reserves for a certain period, they can extend the time the business takes to pay all outstanding accounts in AP.

AP Automation Software Pricing

For instance, while manual invoice processing typically takes days, automation can reduce this to just 3-5 days, boosting productivity significantly. Moreover, the accounting worksheet precision of automated systems reduces the error rates from around 1-3% in manual handling to near-zero, ensuring financial accuracy and compliance. This transformation not only accelerates operations but also allows internal teams to focus on strategic tasks, thereby turning the AP function into a valuable asset for the business. Improved efficiency in accounts payable processes can also lead to better cash flow management and a more strategic use of financial resources.

Vendors and suppliers can receive your payments faster when you submit digital invoices. And it’s easier to confirm payment was sent when you have an electronic trail. We found Procurify’s interface fairly mobile-friendly, allowing users to manage purchase orders, approvals, and expenses on the go. The platform’s real-time budget tracking and customizable reports provide valuable insights into spending patterns, helping businesses make informed financial decisions.