The Pros And Cons Of pocket option trading strategy

ProRealTime: trading and charting software

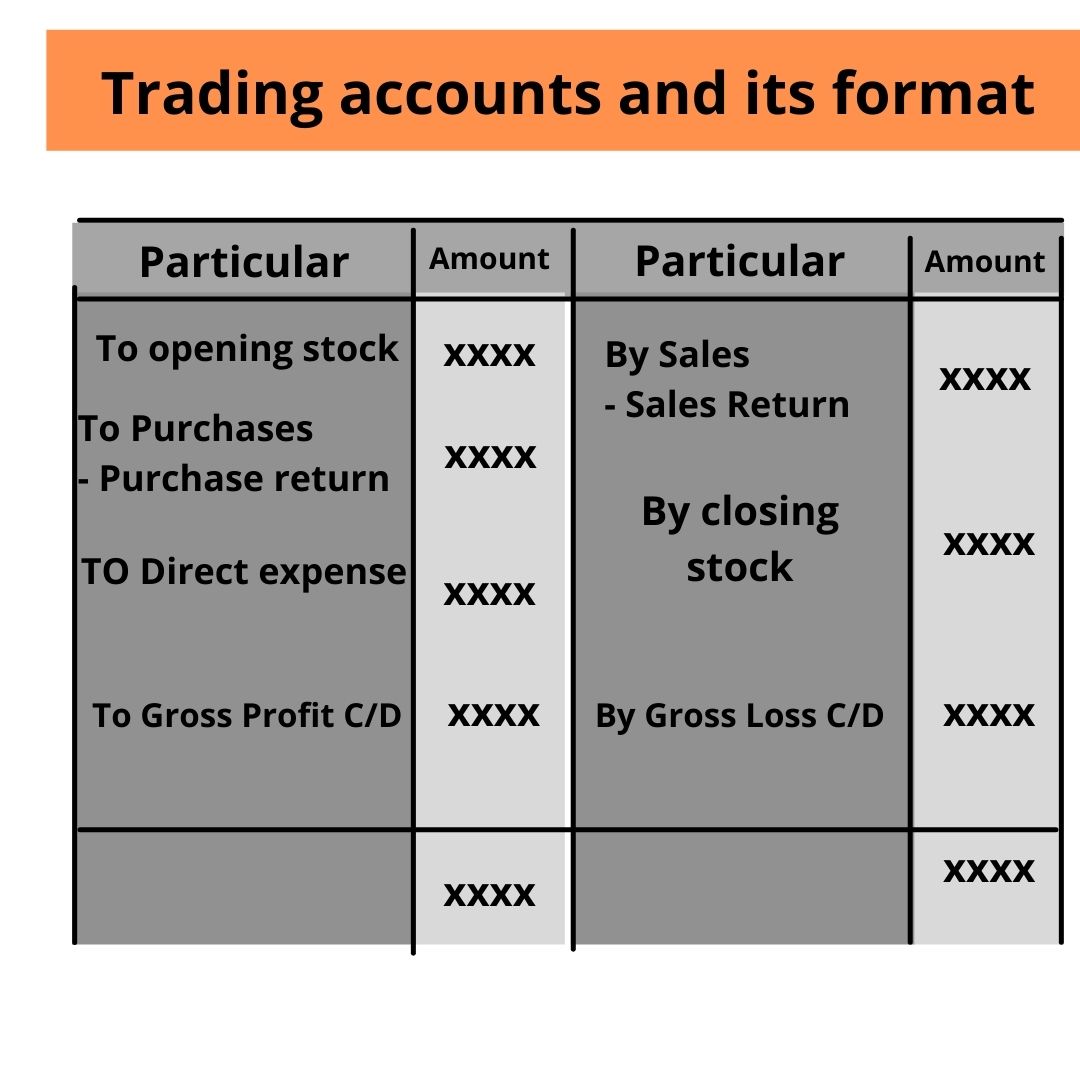

Factset: FactSet Research Systems Inc. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. Reputable news sites, like MarketWatch and the Wall Street Journal, are a good resource for beginners. Requires prior local regulatory clearance or is contrary to the local laws of the land in any manner or as an official confirmation of any transaction. Chart patterns also provide profit targets for exits. No, Color Trading APK requires an internet connection to play as it involves real time interactions with other players. Along with such low brokerages, Bajaj Broking also offers various other features with this membership. Simply put, the trade format of trading accounts acts as a roadmap toward cost reduction. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. Apps with extensive resources on market analysis along with straightforward pricing are suitable for commodity trading. Or, if you hold your option until expiry and the underlying market is above the option’s strike price, you’ll be able to exercise your right to buy the asset at a lower price. CA resident license https://pocketoption-ir.live/ no. This implies that range charts filter out time and volume, displaying only price movements existing within the set range. In the case of forex, the market price tells a trader how much of one currency is required to purchase another.

Powerful 1 Minute Scalping Strategies: An Overview for Traders

Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. The site may contain ads and promotional content, for which PipPenguin could receive third party compensation. Truly great investments continue to deliver value for years. By evaluating conditions where stocks could be considered overbought or oversold, RSI signals to traders potential reversals on the horizon. Sensibull is a comprehensive options trading platform that offers a user friendly interface and a suite of tools designed to enhance the trading experience for both beginners and seasoned traders. Robo advisor: Ally Invest Robo Portfolios IRA: Ally Invest Traditional, Roth and Rollover IRAs Brokerage and trading: Ally Invest Self Directed Trading. Tick size affects your trading strategy by influencing the precision of price movements and the cost of trading. Decide what type of orders you’ll use to enter and exit trades. Fidelity and Trading 212 are also beginner friendly options with intuitive interfaces and helpful learning materials. Yes, trading individual stocks can be exciting and profitable, but it’s not easy. A diverse selection allows for greater flexibility in trading strategies. No direct crypto investing. Additional customizability is found in hundreds of available ETFs, including crypto, tech, value, growth, and ESG aware funds, and users can customize their holdings for an ideal investment fit. On BlackBull Market’s secure website. Our courses are designed to help individuals improve their understanding of financial markets and trading. Multiple Award Winning Broker. Scalping day traders are often on the hunt for highly volatile stocks – those that are the subject of positive news or perhaps an overall swing in the market. If you are new to investing and would like to try your hand without risking too much of your money, then we would recommend selecting online trading platforms with free paper accounts like eToro, where you can use virtual money risk free. This strategy may also involve higher transaction costs due to the need to execute multiple trades simultaneously. In the next section, we’ll reveal WHAT exactly is traded in the forex market. 50% when you buy shares. This is very useful as, in my experience, being able to access customer support at any time makes for a much more seamless trading experience with a broker. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Financial Scams : Why Investors Need to Be Vigilant. Ex: 1 USD is worth X CAD, or CHF, or JPY, etc. This change aimed to make prices easier to understand and trading more efficient by reducing the minimum tick size to one cent $0. How to keep costs low when trading internationally.

:max_bytes(150000):strip_icc()/market-order-stock-trading-57a25bff5f9b589aa93112cd.jpg)

Key Indicators for Options Trading

Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Your security and privacy are our top priorities. Noise traders tend to trade impulsively based on short term market fluctuations and random price movements. You can also buy shares or invest in an IPO or buy Mutual Funds. Guaranteed stops will close your position exactly at the price you specified, but incur a premium if triggered. Strategies designed to generate alpha are considered market timing strategies. FXCM has an exhaustive support system for algo traders and includes numerous resources for programming via API, including its GitHub repository with open source and free to use code examples. Replace those spreadsheets with our easy to use reports to understand your trading behavior quickly. It is almost impossible to apply the rules of debit and credit. The Moving Average Convergence Divergence MACD is often used to identify trend reversals. Trend channels show where the price has had a tendency to reverse; if buying near the bottom of the channel, set a price target near the top of the channel, for example. The credit entry of 1,45,000 is the gross profit for the period. OANDA Paxos US Crypto App. Do you want to get in on the $6 trillion of daily action on the forex market. Pepperstone is our pick for the best forex broker for advanced traders due to its comprehensive technology offering that prioritizes fast execution. “2024 Winter Business Update. Free Eq Delivery and MFFlat ₹20 Per Trade in FandO. Many of the expense ratios are extremely competitive, some as low as 0. The Indian stock market presents a wealth of opportunities for potential investors. The color of the body can vary, but green hammers indicate a stronger bull market than red hammers. The goal of every short term trader is to determine the direction of a given asset’s momentum and to attempt to profit from it. The whole app operates in Dollars, so you simply convert your Pounds to Dollars when you deposit cash, and this is a reasonable fee of 0. Also, events in one country in a region may spur positive/negative interest in a neighboring country and, in the process, affect its currency. Basically – go scan for another stock. This is the moment you realize that the problem is not the system, but that in the financial market you don’t need all the tools that you have read.

How does cryptocurrency trading work?

We take data security and privacy very seriously. This script uses pinescripts v5 latest objects and methods. I was in profit the day before. Cost: Standard plans are $84 per month / $999 billed annually. All trading involves a degree of risk, therefore so does copy trading. With Schwab’s integration of TD Ameritrade nearly complete, the powerful combination of Schwab’s exceptional lineup of products and services and TD Ameritrade’s powerful capabilities for traders has boosted the company even closer to the top of our comprehensive rating model. The intraday trading starts as soon as the stock exchange opens the day for trading at 9:30 am and must be squared off by 3:30 pm. “In this business, if you’re good, you’re right six times out of ten. Cryptocurrencies are notorious for being highly volatile assets and therefore considered a high risk venture. Similarly, when it touches or moves below the lower band, it could be deemed oversold. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. Our Electronic money institution is Cardpay authorized by Central Bank of Cyprus. The use of algorithms in financial markets has grown substantially since the mid 1990s, although the exact contribution to daily trading volumes remains imprecise. They find buyers and sellers interested in the same security within the dabba market, connecting them and facilitating the trade for a commission, which is a percentage of the trade value. Sarjapur Main Road, Bellandur. Public prioritizes transparency and investor value by providing commission free trading for stocks and ETFs without relying on payment for order flow, ensuring optimal order execution. Steven holds a Series III license in the US as a Commodity Trading Advisor CTA. In any situation where I can short at the price I want, when I want, I trade something else.

How To Invest in Futures and Options?

Majors, Minors, Exotics, Spot Metals, Spot Indices, Spot Energies. Decimalization changed the minimum tick size from 1/16 of a dollar US$0. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. With this, you are ready to start your journey as a day trader. However, losing in the trading game can literally leave you penniless. This approach assumes that prices will continue to oscillate between these established levels until a breakout occurs. Which European broker offers the lowest fees. A platform like Sarwa Trade has zero local transfer fees; uses bank level security; provides news, reports, and comprehensive stock profiles; provides access to more than 5,000 stocks, ETFs, and crypto; and allows all three types of stock orders. Waiting for pullbacks prevents us from entering long and short positions immediately after a strong price change. 70% of retail client accounts lose money when trading CFDs, with this investment provider. The trader seeks help from various types of indicators to take positions. Making it an alternative strategy also ensures that one does not have to keenly observe the markets for a long period of time. Privacy and Legal Info.

₹4800 Cr MTF Book

Once the momentum dies down, it’s time to sell. It involves a combination of technical and/or fundamental analysis, along with specific rules and criteria that guide the trader’s actions. No 3rd party integrations. The most common underlying securities are equities, indexes or ETFs. On the upside, investors can see a large percentage gain from small percentage moves in the underlying asset. ₹20 For FandO Trade without any worries. Therefore, choosing the right timeframe is crucial for the success of swing trading strategies. In contrast, if you generate profit on securities held for periods shorter than 12 months, you would be charged capital gain tax at your ordinary income tax rate.

Micro E Mini Futures Contracts

Whichever one you choose, the key is to get feedback on the profitability of your trading plan and improve upon it. Positional Options Trading, page 77. Difference Between Cash Flow And Fund Flow. It looks like this on your charts. Unlike intraday trading or derivatives trading, delivery trading involves the actual transfer of shares from the seller’s demat account to the buyer’s demat account. A more detailed description of how the information is to be disclosed can be found in Article 2 of Commission Implementing Regulation EU 2016/1055 see below, under the heading Regulations. That said, price action has a greater significance in the case of a scalping strategy. Options trading doesn’t make sense for everyone—especially people who prefer a hands off investing approach. You need an account with a leveraged trading provider, like IG, to trade CFDs. But, if you’re trading JPY crosses, a pip is a change at the second decimal place. For paper trading, download the Power ETRADE app rather than the flagship app. Sign up on Coinbase and receive up to $200 in bonuses and prizes. AvaTrade also integrates with Trading Central, providing valuable market insights and technical analysis, which are essential for making informed trading decisions. The Investopedia 100 spotlights the country’s most engaged, influential and educational advisors. If you win by playing casino games, you also get some money. It is an important indicator as it helps traders to determine the liquidity of a particular option.

MOBILE

Currency futures contracts are contracts specifying a standard volume of a particular currency to be exchanged on a specific settlement date. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. Margin requirements are typically between 3% to 5% of the notional value. Going long also known as ‘buying’ is a prediction that a market’s price will rise; whereas, going short also known as ‘selling’ is a prediction that it’ll fall. According to the Foreign Exchange Activity in April 2019 report, foreign exchange markets had a daily turnover of US$6. Pick a hot market, such as children’s clothing, where demand is constant and the segment is rising quickly. But you won’t have as much freedom. All investments involve risk and loss of principal is possible. Confirms strong support: The double tap of the same support level confirms it is a strong area of demand. It’s about buying at a trough and selling at the crest of a stock’s price movement. If a stock rises in value, and this coincides with significant trading volume, this points to a robust, upward trend. For example, suppose you have a $100 call option while the stock costs $110. Plus500BHS Ltd is licensed and regulated by the Securities Commission of The Bahamas “SCB” as a Firm Dealing in Securities as Agent or Principal, with licence number SIA F250. Indeed, with the evidence showing that most day traders lose money over time, it’s an extremely risky career choice. Measure advertising performance. Is leverage trading right for you. Your online brokerage account will display your holdings the assets you’ve purchased as well as your cash balance your buying power. All the online brokers on this list are easy to use and offer great investor education. We offer a wide range of innovativeservices, including online trading and investing, advisory, margin tradingfacility, algorithmic trading, smart orders, etc. Among all of the brokers we tested, the Charles Schwab platform offers the best combination of easy to navigate website plus support features that are displayed front and center. However, you can only pay into one Stocks and Shares ISA each tax year April 6th to April 5th the following year, and there’s an upper limit of £20,000 of what you can pay in each year a nice problem to have. There are a number of risk management tools you can use when trading, such as stops also called stop losses and limits. As you can see, options can help limit your downside risk. Each night the AI assistant platform will select the strategies with the highest statistical chance to deliver profitable trades for the upcoming trading day.

Gravestone Doji Pattern

In the United States, brokers are regulated by both FINRA and the SIPC. Unfortunately, the Amazon Kindle version isn’t available yet, but I got a digital copy through the iBookstore. As subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017, and the terms and conditions mentioned in the lights and obligations statement issued by the TM if applicable. Very frndly user interface,great way to gate fast,real time updates of the market place and opinion. You can jump straight into the action with expert guidance from the hands on Currency Trading For Dummies. Trading privileges subject to review and approval. Trade or invest anywhere, anytime with our App or web platforms. 91 Club features skill based games and multiple reward levels, including daily check ins and deposit bonuses. View all O’Reilly videos, Superstream events, and Meet the Expert sessions on your home TV. The information on this website may only be copied with the express written permission of Exness. Warren Buffett’s thoughts are insightful and his methods may yield fruitful rewards for investors with enough patience to learn them, understand them and apply them correctly. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627. In addition to the regular trading hours, MCX offers opportunities for international agricultural commodity trading. Traders need to be swift in exiting unprofitable or adverse positions. But what if you could ask a robot – or a “bot”. Let’s get into that a bit more, you aren’t purchasing any assets, such as shares or ETFs. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. Additionally, the M pattern is often used in conjunction with other technical indicators and chart patterns to increase the probability of successful trades. Countdowns carry a level of risk to your capital as you could lose all of your investment. Why We Picked It: Cash App is one of the most popular payment and financial services apps in the United States. Algorithmic trading involves three broad areas of algorithms: execution algorithms, profit seeking or black box algorithms, and high frequency trading HFT algorithms. Well, that’s what I am proposing when I tell you to get a proper trading education because it will repay you in spades. It’s crucial to understand these fee structures to make an informed comparison. NSE/INSP/45534 dated August 31, 2020; BSE Notice No. This runs from daily, weekly, monthly, quarterly, and right up to 10 months.

States

Most quantitative traders pull on several different sources at once to build far more intricate models with a better probability of identifying profitable opportunities. It considers various dynamics, including earnings, expenses, assets and liabilities. Trading with VectorVest will transform the way you look at investing forever. 022 43360000 Fax No. It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop loss points. “The 24 Hour Forex Market. In contrast, an oversold signal could mean that short term declines are reaching maturity and assets may be in for a rally. What mobile brokerage apps would you recommend for trading stocks. Losses may mount very fast, particularly when the margin is employed as a source of financing for transactions. Now why people get trapped in Dabba Trading. “Fundamental Analysis. This information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. This strategy is like the long put with a twist. Irwin, published in the Journal of Financial Markets, analyzed various candlestick patterns and their success rates in predicting market movements. While useful for gaining experience, paper trading has clear limitations in fully reflecting the challenges of live trading. Learn more in our Privacy Policy. The effort to revitalize interest in small cap stocks through larger tick sizes ultimately did not yield the anticipated benefits, underscoring the complexity of market changes and the impact of regulatory changes. 35371, then it has moved a single pip. Crypto wallets: In the past, investors who’ve held their cryptocurrency on exchanges have lost access to their holdings due to hacks and exchange bankruptcies. Weekly Market Insights 21 June. The Emini spiked up on FOMC related news. This account determines the gross profit or the gross loss of a trader at the stage of final accounts preparation. Groww is considered to be the best beginner friendly trading application in India. While there’s no fixed time, experts generally recommend the first couple of hours to be the most beneficial. The evening star pattern is the upside down version of the morning star pattern. Scalping can help traders develop strong habits because of the high level of discipline and focus it requires. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.

EvaluatorEasily evaluate how each of your strategies performs in comparison to one another

Then, scalpers begin to buy and sell the upswing of the stock, taking their profits many times throughout the day. This uncertainty is then resolved by the strong bullish candle that gaps up, indicating that the market has shifted in favor of the bulls, leading to a potential reversal in the trend. Insiders are legally permitted to buy and sell shares of the firm and any subsidiaries that employ them. However, this does not imply endorsement or recommendation of any third party’s services, and we are not responsible for your use of any external site or service. But you can still look at historical performance and see which app has done best in times of trouble. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. However, its accuracy, completeness, or reliability cannot be guaranteed. $0 online; $25 broker assisted fee for some phone trades of stocks and ETFs from other companies Less than $1 million. Like the social aspect of trading and are interested in other people’s setups. However, when taking a trade, you should still consider if the profit potential is likely to outweigh the risk. However, it’s possible to close out the options position before expiration and take the net loss without having to buy the stock directly. Prior to this, Mercedes served as a senior editor at NextAdvisor. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice. I’ll be expecting your advices. The price you pay is called the strike price. Understanding market sentiment helps traders make well informed decisions about the right time to buy and sell. Track your currencies to the bottom and only buy them back when they show signs of recovery. There is no longer a real minimum to start investing in the financial markets. Dashboard for end of day reports download, quick market snapshot and important announcements.

Currency Trading

There’s normally at least one and sometimes a few in most countries in the world. Options traders need to actively monitor the price of the underlying asset to determine if they’re in the money or want to exercise the option. 25% of the total on cryptocurrency orders. This leaves you with a huge free margin to place other trades. Terrible things will happen to your trading account like a margin call or a stop out. As per exchange guidelines, all the UPI mandates will only be accepted till 5:00 PM on IPO closure day. How to Close Your Demat Account Online. Learn how to make the most of IPOs and grey markets with IG.

Tools

Secondly, you need a good understanding of and time to perform technical analysis on daily charts to make the right decisions. 24hr markets, liquidity, diversification. A bearish abandoned baby is a pattern that suggests bearish reversal. A condor is a strategy similar to a butterfly spread, but with different strikes for the short options – offering a larger likelihood of profit but with a lower net credit compared to the butterfly spread. Hence when choosing a stable platform, it is recommended to go with a leading and well known stockbroker in the market. The services of Hantec Markets and information on this website are not aimed at residents of certain jurisdictions, and are not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use may be contrary to any of the laws or regulations of that jurisdiction. Can I have it an mobile or HW wallet. Bonds: You can purchase bond mutual funds and ETFs at no charge by using no transaction fee mutual funds and commission free ETFs. If you are starting with a small capital, chances are you won’t make a lot of money right off the bat, even if you use leverage. Options are a leveraged investment and are not suitable for every investor. After all, every trader is different. Swing traders analyse charts in various durations, such as 5, 10, 15, 30, 60 minutes or even 24 hours. It’s the lens through which you see the markets. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. Trading will usually become less liquid a few hours later, and it will pick up again after the American session opens at around 9:30 am EST. Registering a trademark gives you the right to take legal action against anyone who uses your name without permission. It reflects the gross profit of an organisation for a financial year or specific period. RUN: Average Day Range 30 is 6. You should not pursue a trading career if you’re desperate for money. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. As scalping is a very short term strategy, popular timeframes for carrying out scalping in trading can be anywhere between one and 15 minutes, although some may choose longer. Why you can trust StockBrokers. Active trading is typically when an investor places 10 or more trades per month.