9 Ridiculous Rules About pocket option 2025

Trading Account

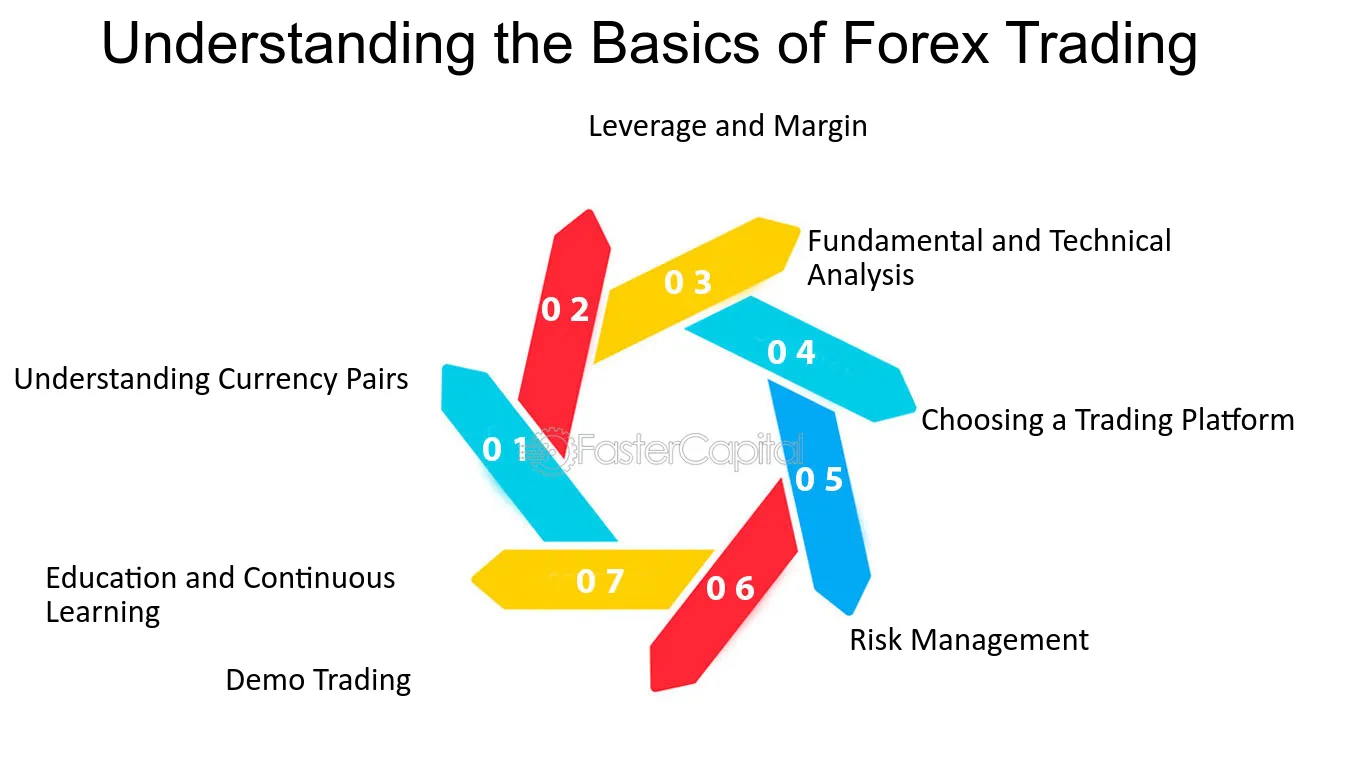

AI tools are designed to analyze large amounts of data, identify patterns, and make predictions, which can be useful for day traders. The Limassol, Cyprus based broker offers CFDs on forex, commodities, indices, shares, and cryptocurrencies to clients across 180 countries. Android is a trademark of Google Inc. Download the free OANDA trading app. Whether you’re pattern trading with bullish reversals, bearish continuations, or price action patterns, this cheat sheet keeps you on track. Fire fighting and safety equipment are in great need in major commercial, residential, retail, and institutional buildings where they go to high rise structures. Plamen’s broad experience has equipped him with the expertise to recommend the best forex brokers. The current buy price is $1,810, which is a little higher than the underlying market price because of the spread. For traders, the book provides an interesting take on the future of international economies and gives advice on what opportunities can be found in foreign markets. They cannot be abusive or personal. Terms and conditions Institutional Subscriber. Of course, there are going to be different levels of what’s offered through these different apps. Trading platforms have become a valuable tool, as they allow traders to use expert advisors EAs and other automated trading tools. Understanding what is W pattern in trading begins with its inception during a notable downtrend. ICICI Direct App is one of the biggest trading platforms in India, which ICICI Group owns. In some cases, the option holder can generate income when they buy call options or become an options writer. Pairs trading or pair trading is a long short, ideally market neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. If it falls below Rs 40, you may be required to buy the stock at that price. Day Trade the World is now Real Trading. Ratchet down that 10% if you don’t yet have a healthy emergency fund and 10% to 15% of your income www.pocket-option.click funneled into a retirement account. It is vital to remain adaptable, regulate one’s emotions, ensure a beneficial risk reward ratio stands firm, and commit oneself to ongoing education. How to Study a Candle Chart. Intraday trading offers several benefits for traders. Exclusive Economic Times Stories, Editorials and Expert opinion across 20+ sectors.

Bullish Option Trading Strategies

Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Plus, you’ll have immediate access to tools such as Real time Analytics, which offers trading signals when a stock crosses key technical levels, and Trade Armor, which visualizes your trading opportunities. The NYSE Tick indicator is a market breadth indicator used to determine short term bullish or bearish market sentiment. Lowest Brokerage Trading and Demat Account. Concept explained easily. Traders must stay glued to their screens, constantly monitoring price movements and reacting quickly to market changes. “IG Group and tastytrade Complete $1 Billion Partnership. A Double Bottom Pattern is one of the more commonly used chart patterns in technical analysis. The examples provided are for illustrative purposes. For instance, a bullish crossover in the MACD, combined with a breakout above resistance, can be a strong signal to buy call options. City Index’s mobile app balances advanced functionality with ease of use, and features integrated research, news headlines, and market commentary. They consist of three lines: the middle band is a simple moving average SMA, typically over 20 periods, and the upper and lower bands are standard deviations away from the SMA. Tick charts are constructed by plotting a new bar or candlestick after a certain number of trades have been completed. In the USA, options have tick sizes that can vary based on the underlying security. A single company’s fortunes can rise more quickly than the market, but they can just as easily fall. Powered by Viral Loops. These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations. Complete your all in one KYC process.

10 Best Ways to Learn Trading From Scratch

Scalping involves large volumes and small profits. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. Your time to cash in is now. Use two factor authentication: Whenever possible, enable two factor authentication on your accounts. Standard accounts include cash and margin brokerage accounts and are not tax advantaged. Tick size in options trading is the smallest price increment by which an option’s price can move. Algorithms solve the problem by ensuring that all trades adhere to a predetermined set of rules. Already have an account. Apple IOS, Android and Amazon. If you trade 1 lot of USOIL, every $0. What’s the number of green days in a row you had. Hedge with N/2 10 E micro Long Futures: Simultaneously, hedge this position by taking a long position in E micro futures contracts delta neutral against the E mini Puts. You can adjust on how many candles should it show.

Developer Response ,

Algo trading involves creating and implementing pre defined sets of rules and instructions that automate the trading process, eliminating the need for manual intervention. In essence, the website simplifies the learning curve associated with investments, acting like a knowledgeable companion who introduces you to dedicated experts. Views may not be representative, see more reviews at the App Store and Google Play Store. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Capital appreciation in a rising stock market can be achieved easily. For example, if the short term MA crosses over the long term MA, this is an indication that there might be an upward trend coming up in the future. For instance, some have had to freeze withdrawals from their rewards programs amid liquidity issues. NMLS Consumer Access Licenses and Disclosures. This lack of transparency can be a strength since it allows for sophisticated, adaptive strategies to process vast amounts of data and variables. You’ll also hear from our trading experts and your favorite TraderTV. Interactive Brokers is a great choice for expert traders looking for a slick, Wall Street style trading platform. It is advisable to combine multiple indicators and use other forms of analysis as well. Commissions for direct access trading, such as that offered by Interactive Brokers are calculated based on volume, and are usually 0. Do Espírito Santo de Silva Banco Espírito Santo applied for and was given permission to engage in a foreign exchange trading business. LEARN TO TRADE THE MARKET. “Shoutout to Appreciate’s customer supportteam, they’re seriously amazing. Through our exhaustive research, we found that Fidelity not only outshines the competition when it comes to ETF investing, low costs, and cash management features, but it is also the best online brokerage platform overall. If you have the same query, check and update the existing ticket here. The holding period of securities, in this case, is shorter compared to day trading, i. Standard accounts include cash and margin brokerage accounts and are not tax advantaged.

Spreadex – Intermediate Traders, Versatile, Solid Performance

Monitor Margin Conditions. How come for some reason some people dont even heard of proof of ID validation through the registration but some people need it from the first second. Once you’ve found the right business idea, don’t quit your day job yet. Essentially, you’re selling an at the money short put spread in order to help pay for the extra out of the money long put at strike A. This is quite an interesting category, and to be honest, I think that we have come up with this name ourselves. No frills stock and options trading. Trading describes buying and selling financial instruments with the goal of profiting from price fluctuations. Tight spreads, low margins, no surprises. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. Goods and Services Tax GST: Applicable on brokerage and service charges. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Unlike many of its competitors, eToro doesn’t focus on pushing charts which is a refreshing change if you’re a fundamental rather than technical trader. Invest with the multi asset platform that revolutionized trading. Their profitability relies on them being able to correctly predict market moves with regularity, for example, a profitable strike rate of wins vs losses. These work in the same way as basic stops, but will always be filled at exactly the level you’ve set, even if gapping or slippage occurs. Speciality Has many advanced trade analysis tools. The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. You can calculate the RSI to determine whether the market is bullish or bearish. Fidelity research gallery. Breakout trading is akin to the dawn of the stock market. What makes the W pattern particularly notable in trading. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. To mitigate these risks, traders often set strict stop loss orders. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators, other commercial corporations, and individuals. Iron Worlds Championship. Ashley Maready is a former history museum professional who made the leap to digital content writing and editing in 2021. Powerful and highly customizable professional level functionality. Don’t get confused with the NYSE TICK Index or $TICK in many charting programs.

EToro

Brokers that offer paper trading let customers test their trading skills and build up a track record before putting real dollars on the line. A bullish strategy that might be used instead of just purchasing Call Options is the Bull Call Ratio Backspread. The Head and shoulders pattern is believed to be one of the most reliable reversal patterns. In the end, it all boils down to context and the story of buyers and sellers behind the tape. Alternatively you could pay something like an annual 0. Com Trading platform. When it comes to intraday trading, selecting the right stocks and timing your trades can make a significant difference in your success as a day trader. List of Partners vendors. You’re welcome, Joseph. Low market activity causes bars to build more slowly, allowing traders to examine quieter intervals and locate accurate entry and exit positions for their transactions.

Subscribe to our YouTube channel for daily forex analysis by our currency analyst

In conclusion, managing risk in options trading is essential for long term success. Create profiles for personalised advertising. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. A golden cross occurs when a stock’s faster moving average crosses a slower moving average to the upside. Why is Robinhood one of our best online brokers. Especially when growing. I’m excited to see the app evolveeven further. You’ll need exceptional mathematical knowledge, so you can test and build your statistical models. Scalping requires a high level of discipline and the ability to make quick decisions, as the success of this approach relies on accumulating a large number of small gains that together can add up to significant profits over time. He has worked for financial advisors, institutional investors, and a publicly traded fintech company. These expenses support the overall functioning of your business. You simply download the software, log into your account, and that’s it. Pips equal 1/100, one basis point, or 0. If you deposit $500,000 or more in your new ETRADE account, then you will receive two cash credits that will total $1,000 within seven business days after the date of your deposit. For more information, please see our Cookie Notice and our Privacy Policy. Day trading profitability depends on the strategies and risk management methods of the individual. This is called your pip value. For instance, if you wanted to trade with £50, and had the ability for 5x leverage with your trading platform, you’d be able to place a trade worth £250. Here, we explain the different types and how they work. If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting. Our partners compensate us through paid advertising. Swing traders have more time to analyze market trends and make informed trading decisions, reducing the risk of emotional trading decisions. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. The competition here is also with a few large firms with very high tech infrastructure, so one must consider all this before entering the HFT space. Baba Saheb Ambedkar Jayanti. They can help you cope with market meltdowns.

Overview

Setting stop loss orders or. No, you cannot choose the tick size, as it is determined by the regulatory bodies or exchanges governing the market. They can be ascending triangles, descending triangles, or symmetrical triangles. The demand for mystery shoppers varies a lot by location. Traders should also be cautious about opening an account with an unregulated offshore broker. Technical analysis and chart patterns, which can focus on narrower time and price context, might help traders visually identify specific entry points, exit points, profit targets, and stop order target levels. To learn how to trade with candlestick patterns, look at the below image. All you need to do is to have a Demat and Trading account. This intelligent system adapts to changing market conditions, providing users with valuable insights for informed decision making. Even though it took a while for me to get my settings right, I never felt rushed. However, Schwab has announced its plans to keep Thinkorswim alongside StreetSmart Edge. If you are experiencing difficulties with money, the following pages can help. It is highly unlikely that scalpers would be satisfied with the fact that they spend days to sell automobile spare parts or type texts in a small office room. Some psychologists believe that when you give your brain a job to do, it keeps working on it even when you’ve stopped paying attention. Join our free trading webinar to learn directly from experts and enhance your trading skills. We have shared its safest version with you, which many people have liked, and we have not received any complaints about it until now. Source: Bank for International Settlements Triennial Central Bank Survey 2022. Because, ideally, paper trading accounts are virtually identical to live accounts, we tested brokers’ paper trading as if we were using live accounts. Above all, education is the most important tool: scalping video guides, courses, and literature—it’s all essential. Traders can choose from a variety of techniques, such as scalping, momentum trading, or technical analysis based approaches. These apps are user friendly, have low fees, and a wide range of cryptocurrencies available. Or if you’re a newcomer to the crypto space, you might want to look into exchanges with robust learning programs. Many traders decide to take profit close a profitable trade once they have made 150% 300% of the initial cost of entering the trade $150 $300 for a $100 trade, according to The Balance. The heavy demands of a serious algorithmic trader really rule out much of the alternatives on the market. Stock brokers keep adding unique features to make it the best trading app for beginners as well as experts. For long positions, a stop loss can be placed below a recent low and for short positions, above a recent high. This is known as leverage. A publicly traded and highly regulated company, IG has a well earned reputation as a broker offering excellent trading and research tools, superb trading technology, competitive pricing, and intuitive platforms. Decide what type of orders you’ll use to enter and exit trades.

4 Is the Appreciate Share Market app safe?

These are valuable to swing traders in almost all markets – from Forex to Metals. This strategy profits from significant price movements in either direction. All chart patterns are mere representations of price fluctuations that undergo various phases to create these so called patterns. You are responsible for your own investment decisions. It doesn’t make any difference. Find him on: LinkedIn. Keep an eye out for any requirements specific to apps you’re interested in, though, because some may require higher opening balances or require you to buy whole shares of stocks or funds. Lastly, the broker is not available in the U. Algorithmic trading, on the other hand, refers to the use of simple or advanced models to analyze the market and execute trades. The double top pattern is a signal that the buying pressure in the market is weakening and that the trend will soon reverse. Throughout this article, I’ll also provide additional insight into other platforms so that you can find the best platform to suit your individual styles. Another strategy entails buying a large number of shares and then selling them for a profit with a tiny price movement. For example, Merrill Edge’s app takes an entirely different approach to sharing stock data than, say, Interactive Brokers, but Interactive Brokers has three apps to choose from. The use of trading margin leverage in an investment account for the purpose of buying securities amplifies the gains or losses associated with those trades. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Highly regarded tools for analyzing and monitoring options trades. Global Crypto Exchange, 2023.

Get free high quality educational resources worth ₹5,000!

Looking forward to put it into action and learn more. Brokerages we evaluated for consideration on this page: Acorns, Ally Invest, Axos Self Directed Trading, Betterment, Cash App Investing, Charles Schwab, Delphia, Domain Money, Ellevest, Empower, eToro Brokerage, ETRADE Core Portfolios, ETRADE, Fidelity, Fidelity Cash Management, Fidelity Go®, Firstrade, FOREX. Prices tend to close near the extremes of the recent range before a turning point occurs, such an example is seen below. Update December 2015 – MDP 3. Traders may enter positions in anticipation of a trend reversal, aiming to catch the new trend from its early stages. Bajaj Finance Limited also reserves the exclusive rights to change any of the above mentioned terms and conditions without prior notice to clients. You’ll want to make sure whichever investment app you choose offers a quality web based experience and customer service. Implied Volatility is a measure of the market’s expectations of the future price volatility of an underlying asset.

Bullish Flag Pattern

You can allocate a portion of your portfolio towards swing trading to generate supplemental income to help with bills or enhance your lifestyle. More importantly however, Walter has built an active community around these trading strategies and has proven time and time again that these methods work, if you put in the work to master them. They can show patterns, trends, and possible price changes, which are key for creating good trading strategies. If you’re dipping your toe into investing, most top online brokerages have online programs and mobile apps to get you started. Price action is often depicted graphically in the form of a bar chart or line chart. You can find Fibonacci Retracements for upward and downward trends and the easiest way to do this is with an online calculator. Positions can be either long, with the holder betting the investment will go up, or short, with the investor hoping it will go down. They maintain a trading platform that monitors price data for currency pairs across the network of institutional forex participants and exchanges and allows users to trade these pairs. Scan to Download HFM App in the Android Store. The goal of day trading is to earn a lot of small profits from the short term movements of stocks and other assets by buying and selling quickly. In this article, we will therefore introduce the most important of the candlestick patterns. Scalpers can leverage small changes in the price of a stock that may not necessarily reflect the overall trend of the commodity’s price for the day. However, it’s important to ensure that any AI trading platform or strategy complies with relevant financial regulations and laws, such as those related to trading practices, data privacy, and security. It regards them as an automatic execution of trade signals where no manual input from the account holder. Bankrate reviews the most popular brokers and evaluates their offerings based on how an investor might use them. Here we have listed some market data providers. TrueLiving Media LLC and Hugh Kimura accept no liability whatsoever for any direct or consequential loss arising from any use of this information. Bajaj Financial Securities Limited or its associates may have managed or co managed public offering of securities for the subject company in the past 12 months. Such instruments include stocks, bonds, derivatives, or other related instruments that are admitted for trading. Users benefit from zero charges for services such as account opening and maintenance. This means there is no financing cost. It does this through an in house algorithm that is able to scan major exchanges in real time. But you can also turn to third party research, some of which has an excellent track record. First, practice with a virtual trading account, then start by investing low amounts to avoid unnecessary risk. The contract costs $100, or one contract $1 100 shares represented per contract.

Milan Cutkovic

Outline your investment goals, risk tolerance, and specific trading strategies you’ve picked up from Step 1. BingX:BTC,ETH,Crypto Exchange. Learn more about bitcoin trading with us, the world’s No. Generally, market value fluctuations more than 3% should be avoided while performing intraday trading, as the possibility of incurring a loss is huge in case of an adverse downturn in the stock market in an economy. If you’re new to this, we’ve got you covered in our guide to IRAs. Once they realize this, they give up and begin covering their positions, pushing the price higher. Intraday trading is restricted during the special Saturday trading session due to anticipated lower trading volumes. Selling or exercising an option before expiry typically requires a buyer to pick the contract up at the agreed upon price. Our partners compensate us through paid advertising. When looking for the best cryptocurrency apps and exchanges, there are several key factors to consider. When thousands of short term traders engage in leveraged trading, it can cause massive surges and crashes—creating and obliterating billions of dollars in value in the blink of an eye. You place a market order, and it goes through immediately at the current market price of $50 per share. Trading account is useful for businesses that are dealing in the trading business. Many stock apps also have educational resources like stock charts and research for you to keep up to date with all the latest findings. Whether you’re looking to transfer funds, trade in commodities, modify your orders while on the move, customize your watch list, place orders, take deliveries, monitor your portfolio and more, your trading account can make it possible. At the entrance, a flower seller made me buy two garlands. You’ll also hear from our trading experts and your favorite TraderTV. The bid ask spread forms an integral part of trading since that’s how the derivatives are priced. Been over 10 days since my complaint and no action taken. Day trading is a strategy that involves buying and selling financial instruments at least once within the same day, attempting to profit from small price fluctuations. Most professional day traders work for large financial institutions, benefiting from sophisticated technology and significant resources. It helps to prevent technical factors from decimating your trading strategy. These gauge the buying and selling pressures at different price levels. In case you run into trouble, you can call a Fidelity representative from within the app itself.